DeFi's Dividend Dichotomy: A Capital Markets History Lesson

Why did investors slowly stopped caring about dividends? What can DeFi learn from this?

Why did investors stop demanding dividends from stocks? Because they used to insist on them, just like DeFi does now.

DeFi needs more awareness of our TradFi parallels. Many of our problems, discoveries, life cycles, etc. are not new. DeFi is often said to be “Speed running financial history”; this means we can glean historical wisdom from lessons that have already been learned. We would be wise to heed them. Let’s predict crypto’s future and clarify its present, by looking to the past.

1600s-1900s: What Does the Stock Do?

2020s: What Does the Token Do?

An instance of said speedrunning that’s happening right now: the insistence that fee sharing makes a token valuable. AKA staking. AKA “utility”. AKA “if the token doesn’t have yield, what does it do?”

TradFi has a name for this, it’s called dividends. Back in the day, they didn’t care much for abstract notions of equity in a business, they wanted cold hard cash for holding your stock. Right now, DeFi is of a similar mindset. Parallels.

1600s-1900s: “If it doesn’t pay dividends, what does the stock do?”

2020s: “If it doesn’t let you stake for yield, what does the token do?”

We’re doing the speedrunning financial history thing again. Flat circle.

Let’s review historical examples of what TradFi already experienced, and what DeFi will eventually make peace with.

Stocks 1.0: DeFi and TradFi Parallels

Our TradFi ancestors shared many of the sentiments DeFi presently does, and at one point stocks with no dividends were unacceptable! They used to demand ‘real yield’ (a cut of earnings), because otherwise what else does the stock do? TradFi’ers once understood stocks from this lens, yet now only 50% of the Nasdaq pays a dividend… how did we get here?

The instinct to tie the value of an abstract, intangible asset to something recurring and concrete is logical. There are a lot of scams out there, and proof of profitability via payouts is a solid heuristic for avoiding them. Back then if you could pay dividends, you’re a legit company; now if you can return yield to tokenholders, you’re a legit DeFi project. Dividends were/are partly a form of costly signalling for earnings expectations.

However, this heuristic now carries inverted utility for growth investing.

In modern finance, if you’re paying a dividend that means you don’t have enough growth prospects to invest in, so you return money to shareholders. If you’re rapidly growing, you keep your earnings and deploy it back into the business. I’ll cover this in more detail in a bit.

A Brief History of Stocks and Dividends

The first instance of an IPO and publicly tradable stock in financial history came in 1602 from the Dutch East India Company, ticker VOC for Vereenigde Oost-Indische Compagnie.

The impetus for VOC stock provides insight into business models and investor expectations from that era. VOC needed big chunks of capital for specific reasons: to finance voyages for its massive spice trade. VOC issued stock and bonds to fund highly uncertain expeditions, which could either pay out a lot or nothing at all. If the voyage was successful then everyone got paid, if not then no dividend.

Capital markets used to view stocks essentially as junk bonds.

They paid a dividend that was greater than the debt coupon, however it was junior in the payout waterfall and contingent on certain degrees of success.

Here’s an example prioritized payout structure:

1st: Bondholders receive interest payments (eg 4%)

2nd: Preferred shareholders are paid next. More than bonds, but less than common stock (eg 6%)

3rd: If there’s remaining profit, then common stock gets paid. This dividend was the most uncertain, but also the largest (eg 10%).

Fun fact: sometimes dividends for VOC holders were in the form of pepper, nutmeg, cloves, and other kinds of spices! Imagine dividend day arrives and you get a big chunk of oregano in the mail. RETVRN.

Important: Past companies issued equity for specific endeavors that required a large amount of money at once. Eg we’re going on a voyage, we’re building a factory, a railroad, etc.. Growth was achieved in chunks, not increments; this is not how growth works today.

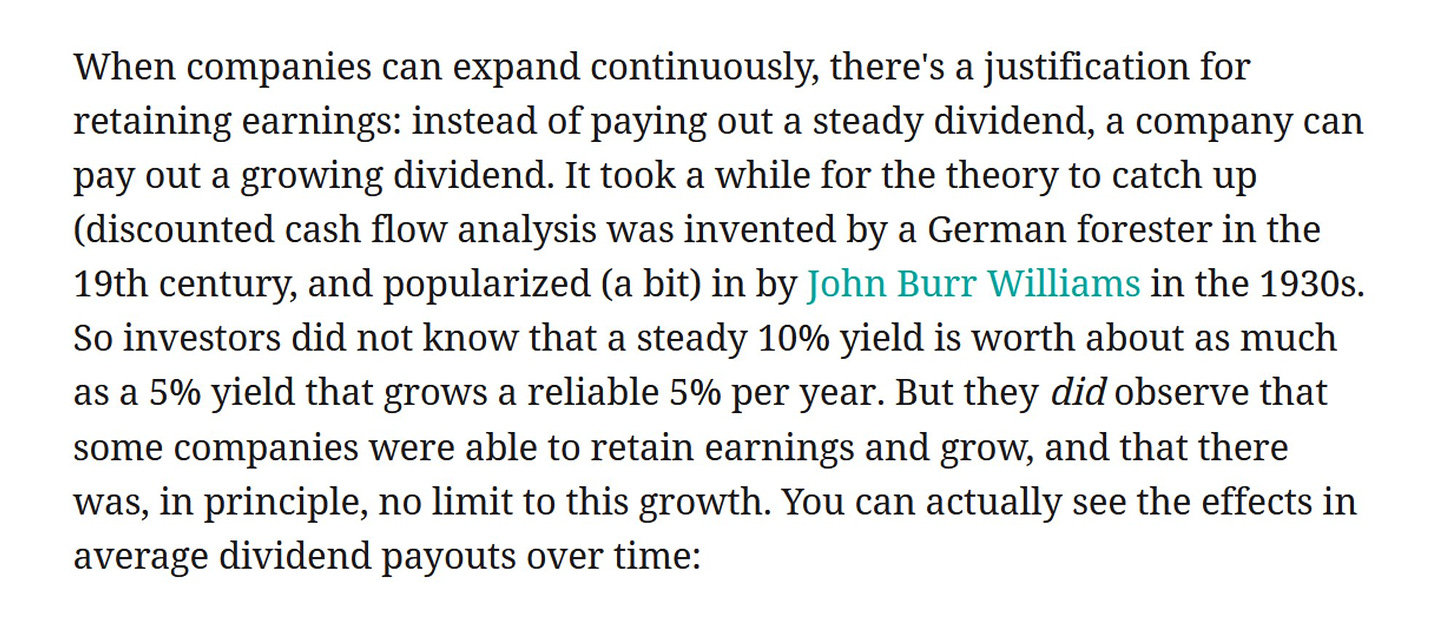

Investors gradually became more and more okay with companies paying out less of their retained earnings and keeping it for themselves. This largely has to do with incremental reinvestment in the business becoming more feasible, making those earnings more valuable and useful to the company. Increased access to utilities like electricity then and cloud computing now meant every dollar you earned could be reinvested more effectively. Technology made keeping your earnings go further.

You no longer needed to raise large chunks of capital to fund a voyage or break ground on a new factory. Technology allows growth to be financed in a persistent stream of reinvestment, rather than requiring big slugs of capital.

In modern times, businesses can use their profits for generalized, gradual expansion; you can do something productive with $500k or $50M. The old-school mindset was “we need $20M for an investment we think will make X amount of money, and we’ll pay you Y if it does”. If a voyage costs $20M, keeping a fraction of that as retained earnings doesn’t do you much good, so you paid it out. Growth came in waves, not so much in persistent increases.

Here are excerpts from the brilliant Byrne Hobart that are very much worth your time. He’s incredibly insightful on dividend evolutions and the reasons behind them; I deeply appreciate this kind of nuanced analysis and draw heavily from it.

—

Capital gravitates to its most efficient uses, and it makes intuitive sense to me that earnings distribution vs deployment would evolve in a way that favors deployment back into the company. For the same reason water takes the most direct path downhill, capital eventually flows to its most productive uses.

—

Investor Expectations and Returning Capital

A company can do two things with earnings. Two. You can:

Reinvest the money into the business

Return the money to shareholders

Early-stage VC-backed tech companies — that are rapidly growing — raise money in hefty rounds for multiyear continuous growth. And these startups are well-known for paying fat dividends…. 🙃

Do you know how many startups pay a dividend? Zero. Why? Because they use that money to 1000x by investing in growth. Pre-revenue, positive unit economics, it doesn’t matter, you do one thing with that money: grow, aggressively.

(I’ve only heard of one previous startup paying dividends: Kickstarter. And they’re extremely weird and not a big growth story.)

If investors wanted a dividend, they’d buy a tobacco company or bonds. We’re here for capital gains, not 4% yields. Paying a dividend would essentially be a sign of failure for a growth business… “Here take your money back, we can’t find enough productive things to do with it.” Empirically, investors now value growth above all else, and would rather management keep the money if it can be redeployed into expanding the company.

Investors just don’t care about “real yield” like they used to.

The environment for what contemporary businesses need to grow is much different than VOC times. Earnings can now be productively reinvested into the business and have a higher ROI to the company than paying them out, and modern shareholders are more than ok with this.

Walmart should pay a dividend, Cloudflare should not. Where do DeFi projects sit in this spectrum?

GrowthCo’s do not pay dividends, and they’re the most richly valued stocks. OldCo’s need to entice you with dividends, because performance isn’t cutting it anymore.

DeFi projects (crypto startups) have no such VOC-style limitations of yesteryear, yet the cultural demands act as if we’re going on a spice expedition.

Financial Natural Law, 100x or 5%: Pick One

Do you buy a hypergrowth company for a 5% yield or a 100x capital gain? You know how you’re going to get that 100x? By the company growing rapidly. Do you know how the company will grow rapidly? By spending a lot (a lot) of money on marketing, product, marketing, employees, product, and marketing. It’s expensive out there.

DeFi is constantly hunting for the next 100x gem while also asking “do we get yield too?”. That’s speaking out of both sides of your mouth. You can’t be a long-distance runner and a bodybuilder simultaneously. If someone promises you both… recall the saying on free lunches.

The growth-vs-dividends dichotomy feels tantamount to finance natural law. No reward without risk. No huge gains without volatility. To want 100x and 5% is to seek stability and volatility concurrently. To want reliability and wife-changing returns from one asset. It’s a contradiction. Our devs have not outprogrammed the rules of leverage nor have they reinvented axioms of economics.

Show Me the Culture and I’ll Show You the Outcome?

I’ll end with an interesting cultural insight: in the 19th century and earlier, wealth was often measured in terms of annual income, not the value of your assets. The historical emphasis on dividends makes a great deal of sense when you consider this social-signalling component.

It’s the exact opposite today. The ultra-wealthy only speak in terms of capital gains and asset prices. Even lower classes look to asset-based net worth as the barometer of wealth, not your dividend streams.

Considering that absolutely no one in crypto measures their wealth in staking yield, I don’t think it’ll take too long for us to speedrun the dividend thing. DeFi is currently in its VOC phase. This too shall pass.

Follow BackTheBunny

Fire post as always!

hey man, follower who found you through the crypto twitter circle. your content is bloody awesome. keep up the hard work!