Governance Tokens, Tech Stocks, Dividends, and "Utility"

What is your "equity" equity in, exactly?

DeFi needs more awareness of our TradFi parallels. Namely how our problems, discoveries, life cycles, etc. are not new. The point of these essays is to predict the future and clarify the present, by looking to the past. DeFi is not reinventing human behavior or financial axioms; we are creating superior environments for them to take place.

Your Equity Is not Equity

Stock "equity" isn't exactly what it's presented as anymore. In fact across many dimensions, it’s quite similar to DeFi governance tokens. This essay is a functional breakdown that decomposes these two assets.

There’s a hyperfocus on DeFi projects’ revenue distribution, often found in the phrase “stake for yield” or “fee switch”. This means you receive a dividend when you own the project’s token (it’s the exact same thing as a dividend). I don’t know why DeFi felt compelled to rebrand the term "dividend", maybe because it feels more community inclusive.

Is this dividend necessary for the token to accrue value? Does it give it “utility”? What do we even mean when we say that?

I’ve taken CFA tests, have worked in finance, and understand the official DCF theories. What I’m interested in is situational reality; what do you actually get at the end of the day with stock ownership? When does the claim on cashflows happen? What does equity even mean anymore?

Last I saw figures on it, about 70% of stocks pay a dividend, and the most richly valued ones (tech and high-growth stocks) almost never do. Only 50% of the Nasdaq pays a dividend. And no startup pays one. No cash will ever be returned to you from many of these stocks, no claim can be exerted on their resources from the average holder. So why do they track the underlying business?

It's odd how we describe dividends as "utility" in DeFi, but no one says a tech stock has/doesn't have utility based on if it pays dividends.

A Claim on Cashflows…?

You can’t claim any cashflows from Cloudflare with your NET or Nvidia with your NVDA (send their investor relations an email requesting a cashflow, see what they say), but can you claim anything with it? What if the company gets liquidated?

Well, not really. Especially if they're tech companies. Most tech company assets are intangibles. Intangibles are things like IP, goodwill, the spoils from research and development, etc.. They're the brand and service they've built via investing through the income statement, not the balance sheet.

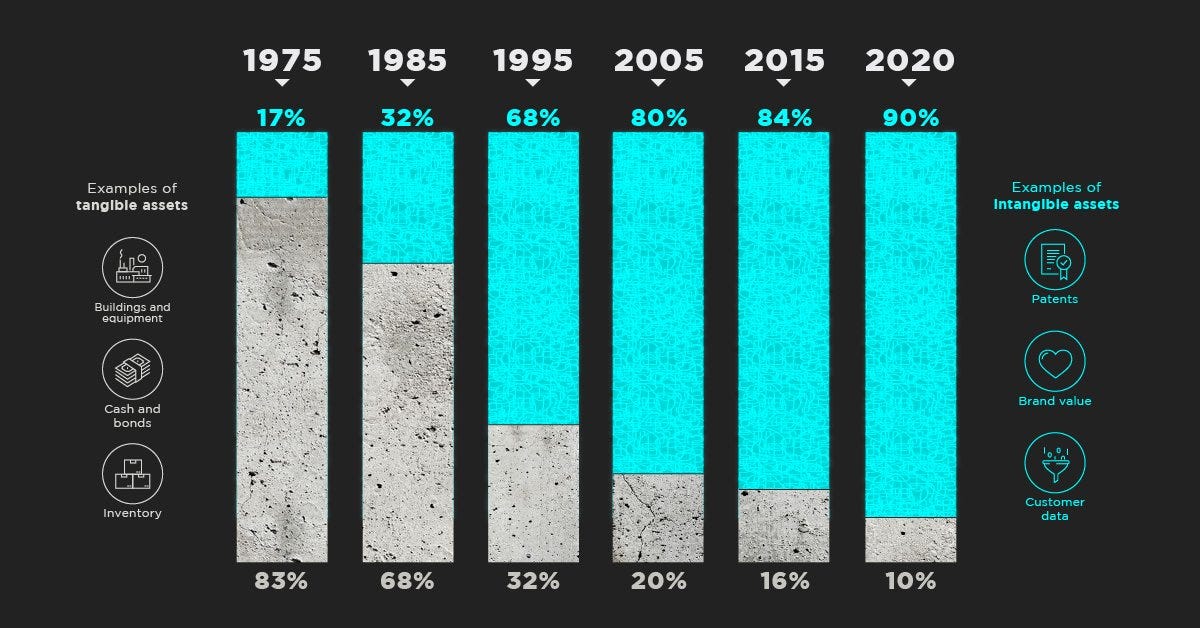

Here’s an infographic on how tangible assets for US companies has been declining, broken down in 10-year chunks. As you can see, it's mostly intangibles now.

This means there's no factory for you to lay claim to in bankruptcy (a factory or equipment would be examples of tangible assets). No hard assets to be sold off to make you whole. You have no “equity” in anything concrete here. The investments these tech companies make are often in things that seem periphery like customer support and advertising, but are critical capital assets of the tech world.

These squishy tech assets are very valuable... to the company. But they have little salvage value in liquidation. Common stock is a junior claim on assets if the company fails: debt holders get first claim, then preferred stock, then if there’s anything leftover, common stock gets something. There are no leftovers for stockholders when the company has no book value.

And you sure as hell aren't investing in a tech company, or any company, hoping you get scraps in bankruptcy. That means the company failed and the share price was decimated. And you're not going to get anything anyways, because the tech company has little salvage value for its assets because they're all intangibles. What is your "equity" equity in??

So what are you getting when you buy NET?

No cashflows

Nothing in bankruptcy

Voting rights!

When you buy NVDA, CFLT, NET, basically anything in WCLD, etc. all you get is to vote in shareholder meetings. Neat! Wait, what's a governance token again?

The financial laws of physics dictate the valuation of equities follows some DCF iron rule that says they go up in price as revenues, cashflows, margins, etc. increases, though for many stocks, you will never touch the cash those companies generate. You will never exercise any claim on the company’s assets. So what exactly is your “equity” giving you equity in?

If that tech company fails, the stock is a zero. And there are no assets to be sold off to make you whole. The vast majority own a governance token with no cashflows, and yet the stock’s valuation is tied to company performance.

I believe there is one reason for this, and it only applies to whales and has nothing to do with academic theory underpinning what equity purports to be. I will explore this in a future essay. Stocks have evolved substantially over centuries into an entirely different asset class, and no one has updated their priors.

Stocks Can't Rug As Easily?

I’ve heard some say legal protections make stocks safer, and from a “rugging the business” standpoint, that’s true. However this is value-accrual analysis, not a legal-protections one. Why does the treasury of Cloudflare make NET more valuable when you’ll never touch one penny of it by holding NET? Yes the CEO can’t steal the corporate bank account, whereas in crypto he can more easily. But that doesn’t change how you'll never get anything valuable returned to you from owning NET.

On Share Buybacks

Some important points on share buybacks vs dividends: they're technically the same thing if you're taking a CFA test. I understand the accounting logic and the tax-advantaged approach. But it doesn't refute the central point being made.

Reducing the quantity of something doesn’t in and of itself make it more valuable. The question is still “why was this valuable to begin with?”. Buybacks don’t tell me why the stock is intrinsically worth anything, it just tells me there’s less of it now. “Less of something” is not a value-accrual argument.

You're still not getting any income stream with buybacks, and you still have no functional claim on company assets. How do you acquire actual dollars out of your stock, post buyback? You have to sell those shares to get anything. You receive absolutely nothing by virtue of owning them besides… voting rights.

This artificial-scarcity act pleases the DCF gods that say your stock price should go up now by virtue of there being less of them. But for almost everyone, you still just own a governance token. A share that only lets you vote, has no profits returned to you, and has no real claim on any resources.

There is one exception to this. One. Your equity is not equity, unless you own enough of it. More to come.

Follow BackTheBunny